2021 Form AL 40A Fill Online, Printable, Fillable, Blank pdfFiller

State of Alabama Client Assistance Program Montgomery AL

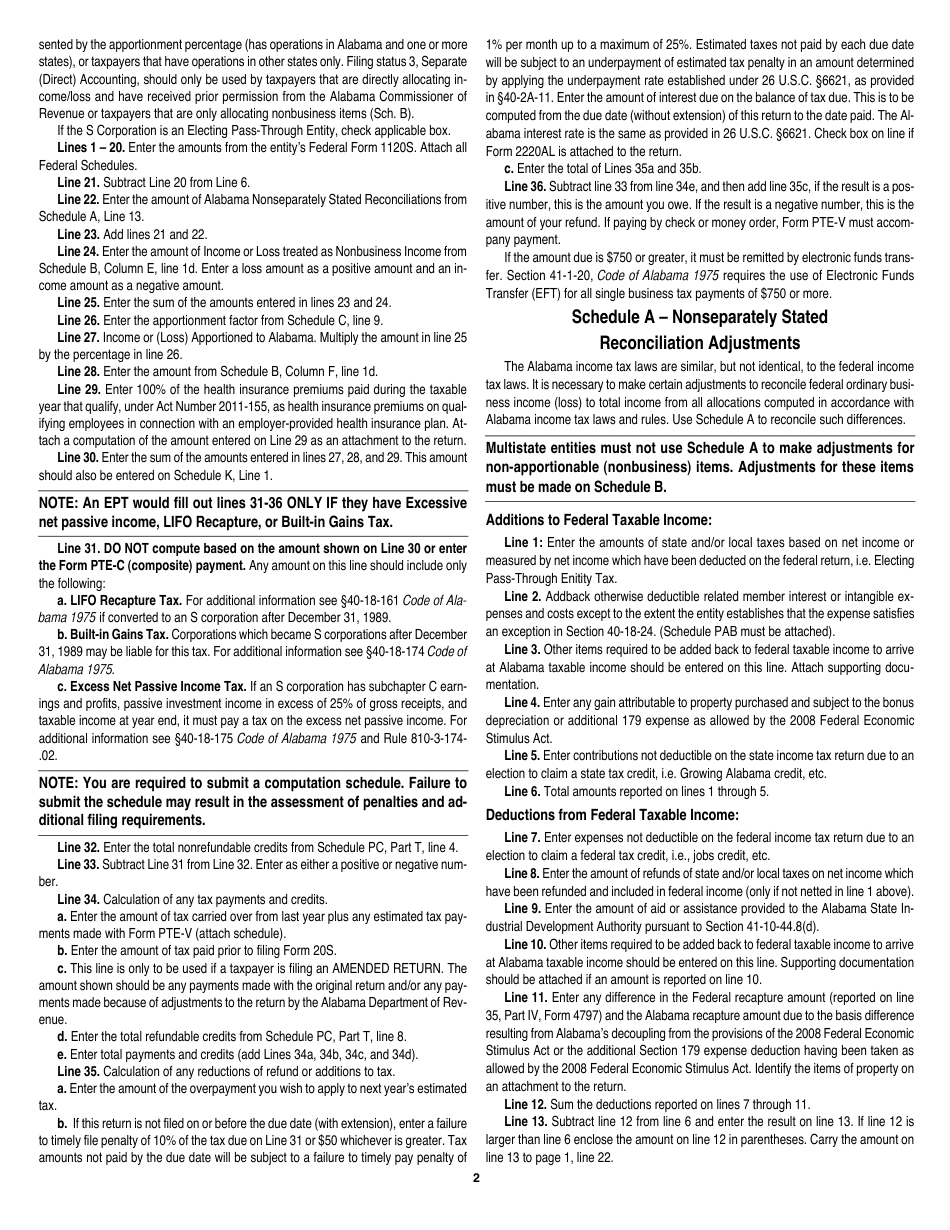

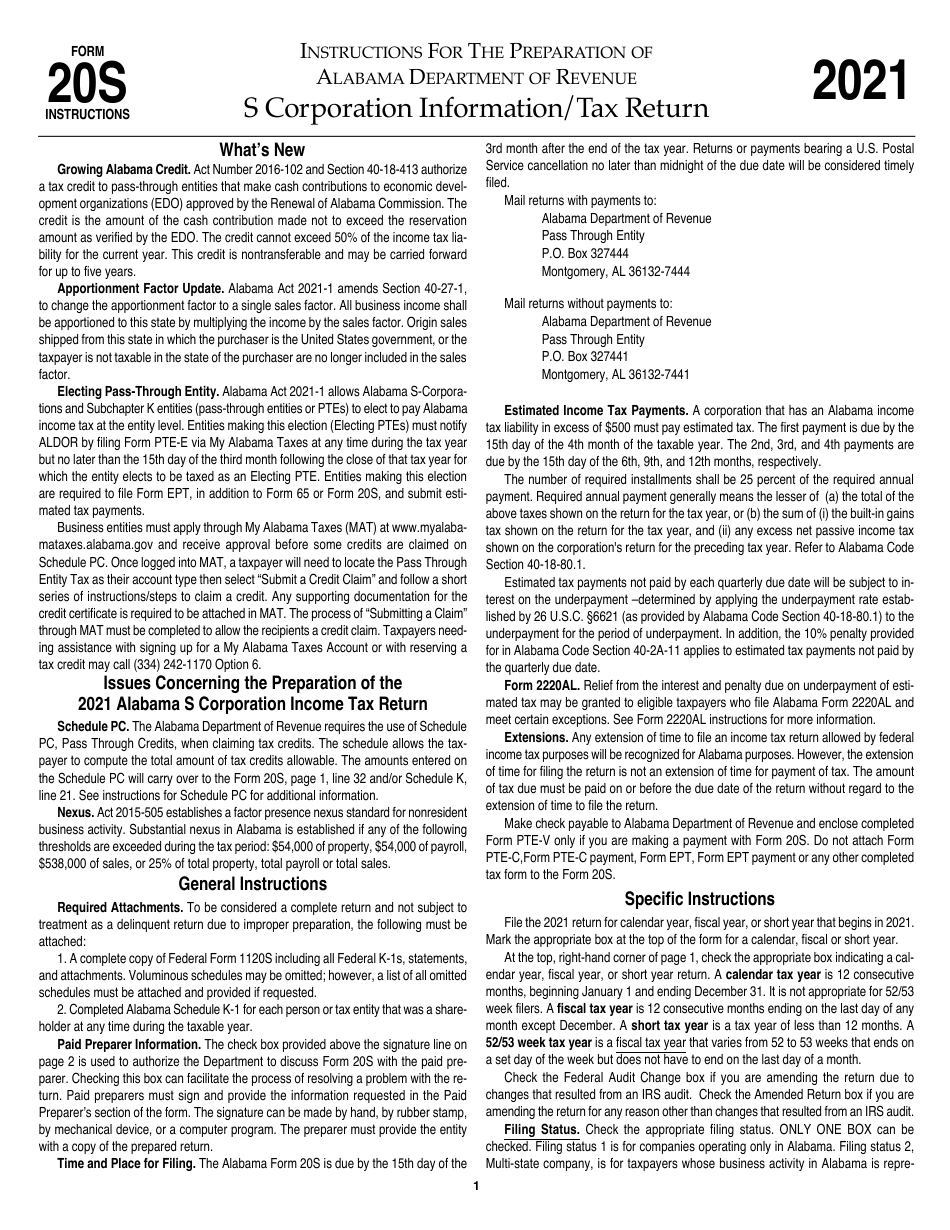

Alabama Act 2021-1 allows Alabama S-Corporations and Subchapter K entities (pass-. tion are required to file Form EPT, in addition to Form 65 or Form 20S, and submit estimated tax payments.. Specific Instructions File the 2021 return for calendar year, fiscal year, or short year that begins in 2021. At the top, right-hand corner of page 1.

Alabama Crimson Tide Shirt of the Month Club

please call 251-344-4737. To report non-filers, please email. [email protected].

Download Instructions for Form 20S S Corporation Information/Tax Return

Download or print the 2023 Alabama Schedule K-1 (Form 20S) (Pass Through Shareholder's Share of Income, Deductions, Credits, etc. (Form 20S)) for FREE from the Alabama Department of Revenue.. etc. • Electing Pass-Through Entity 2023 • Final K-1 SEE INSTRUCTIONS Tax year beginning _____, 2023 and ending _____, 20_____ PART I PART III.

2018 Form AL DoR 40V Fill Online, Printable, Fillable, Blank pdfFiller

Amended K-1. PART I. Information About the Pass Through Entity. PART III. Owner's/Shareholder's Share of Current Year. Alabama Income, Deductions, Credit, and Other Items. A. Entity's Federal Employer Identification Number. Income allocated and apportioned.

Download Instructions for Form 20S S Corporation Information/Tax Return

The Alabama Form 20S is due by the 15th day of the. 2021. 3rd month after the end of the tax year. Returns or payments bearing a U.S. Postal Service cancellation no later than midnight of the due date will be considered timely filed. Mail returns with payments to: Alabama Department of Revenue Pass Through Entity.

Greater Alabama Council Exploring Birmingham AL

Alabama Corporation Income Tax Return Form 20C *2300012C* FORM 20C •CY •FY •SY •52/53 WK Alabama Department of Revenue Reset Form Corporation Income Tax Return 2023 For the year January 1 - December 31, 2023, or other tax year beginning •_____, 2023, ending •_____, _____ Check applicable box: • PL 86-272 Initial • return Final • return • Amended return Federal • audit.

_1904.jpg)

FileUSS Alabama (BB8) 1904.jpg Wikimedia Commons

FORM 20S - 2020 Page 3 SCHEDULE C - Apportionment Factor Schedule. Do not complete if entity operates exclusively in Alabama. SCHEDULE D - Apportionment of Federal Income Tax ("FIT") (LIFO Recapture Tax Only) SCHEDULE E - Alabama Accumulated Adjustments Account 15.

Associated Builders and Contractors, Inc. Alabama Chapter

Form PTE-V only if you are making a payment with Form 20S. Do not attach Form. PTE-C,Form PTE-C payment, Form EPT, Form EPT payment or any other completed tax form to the Form 20S. Specific Instructions. File the 2022 return for calendar year, fiscal year, or short year that begins in 2022. Mark the appropriate box at the top of the form for a.

Alabama State University Department of Social Work

ALL. BF-1. Application to Become a Bulk Filer. ALL. Form 6014-A. Authorization for Access to Third Party Records by Alabama Department of Revenue Employees. ALL. B&L-PR. B & L Petition for Review of Preliminary Assessment.

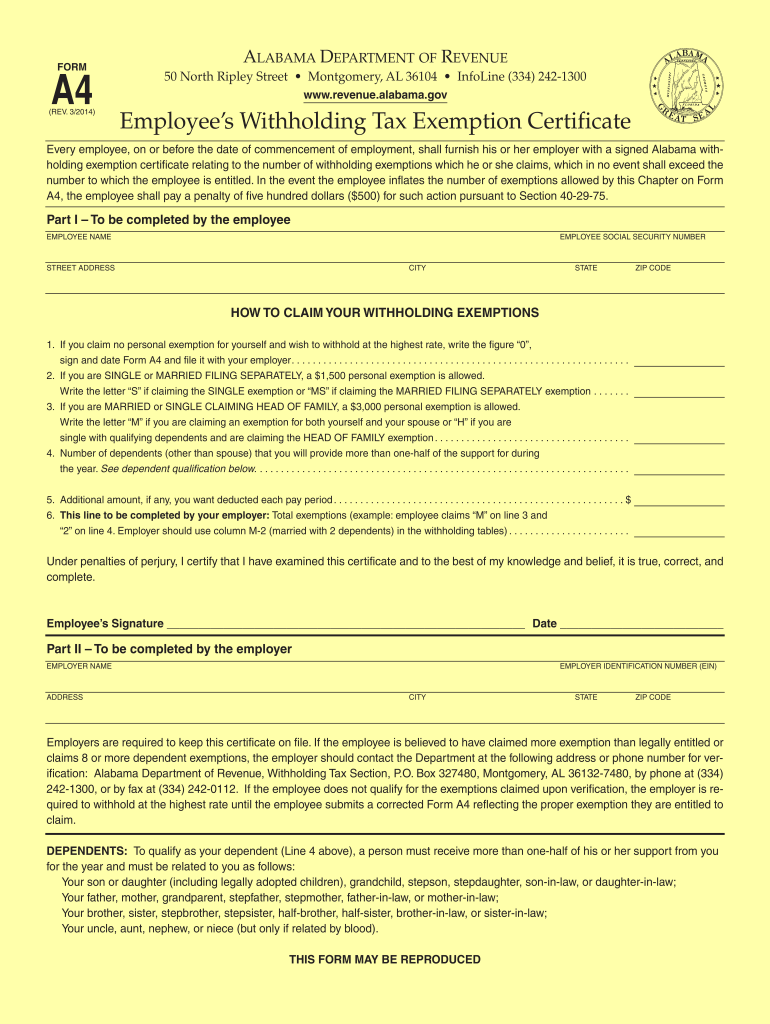

20142021 Form AL DoR A4 Fill Online, Printable, Fillable, Blank

Download or print the 2023 Alabama Form 20S (Alabama S Corporation Information Tax Return) for FREE from the Alabama Department of Revenue.. (see instructions) Important FEDERAL BUSINESS CODE NUMBER • • Check • 1. Corporation operating only in applicable box: NAME Alabama. • • 2.. 2021 Form 20S 2020 Form 20S 2019 Form 20S 2018.

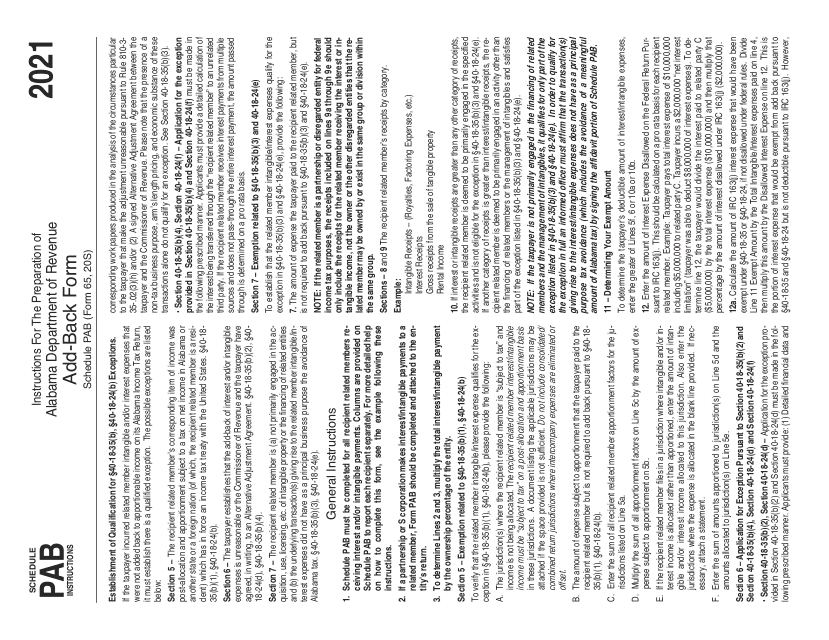

Download Instructions for Form 65, 20S Schedule PAB AddBack Form PDF

FORM 20S - 2021 Page 4 SCHEDULE G - Other Information 1. Briefly describe your Alabama operations: • 2. Location of the corporate records: • 3. If the privilege tax return was filed using a different FEIN, please provide the name and FEIN used to file the return: FEIN: • NAME: 4.

2021 Form AL DoR 40NR Fill Online, Printable, Fillable, Blank pdfFiller

ALDOR has released updated pass-through and fiduciary instructions: Form 20S Instructions ; Form 20S ; Form 41 Instructions ; Form 41 ; Form 65 Instructions ; Form 65 ; 11/4/2022. Back To List. Events & CPE Catalog. Alabama Society of CPAs. 1041 Longfield Court Montgomery, AL 36117 (800) 227-1711. Connect. Member Publications; Chapters; Young.

Alabama Entry Form Fill Out, Sign Online and Download PDF

Alabama Act 2021-1, Section 6 amends Sec-tion 40-27-1, to change the apportionment factor to a single sales factor. All business income shall be apportioned to this state by multiplying the income by the sales fac-tor. Origin sales shipped from this state in which the purchaser is the United States government, or the taxpayer is not taxable in.

Alabama Utility Contractors Association Birmingham AL

The 2021 Form 2210AL should be submitted with the 2021 individual income tax return. FAQ. Follow the instructions to make the election.. of Title 40, Code of Alabama 1975. Use the total of total of lines 1 through 17 in the Alabama column on Schedule K, Form 65, or Form 20S, to determine Alabama taxable income. Alabama tax paid under this.

Alabama Democratic Party lgbtq+ Caucus

*2200042S* FORM 20S - 2022 Page . 4. SCHEDULE G - Other Information. Briefly describe your Alabama operations: 1. • 2. Location of the corporate records: •

Download Instructions for Schedule OC Other Available Credits PDF, 2019

The Alabama Department of Revenue's website (www.revenue.alabama.gov) has available Alabama S corporation tax laws, regulations, forms and instructions. Line 1. Enter the ordinary business income (loss) from page 1 of the fed-eral Form 1120S, U.S. Income Tax Return for an S corporation. Attach a copy of the complete federal Form 1120S.